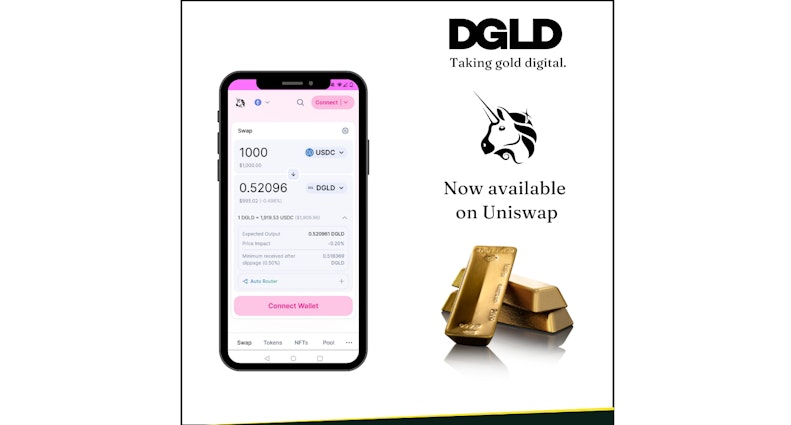

DGLD now available via the Uniswap exchange

GTSA is glad to announce the launch of the very first decentralised liquidity pool for DGLD available here. The Uniswap V2 liquidity pool for the DGLD token is a significant development in our efforts to offer the most secure, transparent and responsibly sourced gold token to a global userbase. Every DGLD, representing and fully backed by one fine ounce of gold, is a digital proof of ownership of physical LBMA gold held in Swiss, insured and audited vaults. The Uniswap V2 pool will offer USDC:DGLD pairing, with an initial liquidity of USD1MM, providing users with a transparent and highly accessible venue for users to trade and access this gold-backed token.

The launch of this liquidity pool is particularly relevant with ongoing concerns about the lack of transparency and trust in centralised trading venues. GTSA aligns itself with Uniswap’s mission of eliminating unnecessary forms of rent extraction, allowing safe, accessible, and efficient exchange activity. Uniswap offers 24/7 accessibility, allowing for seamless swaps at any time of the day. Additionally, Uniswap is interoperable with other decentralized applications (dApps), making it easy to integrate them into a wider ecosystem of decentralized financial services.

The Uniswap V2 liquidity pool for DGLD has been seeded and managed by our strategic partners to ensur that the pool has sufficient liquidity. The pool will be actively managed to ensure sufficient liquidity and price stability of DGLD around the underlying gold price. At its current size, the USD 1MM pool will support up to USD50K daily demand, with the ability to increase liquidity within the pool to support larger trades when demand arises. The DGLD pool also provides the first opportunity for investors to generate a yield for DGLD by contributing to liquidity in the pool, as well as profits for arbitrageurs.

One of the key benefits of the Uniswap V2 liquidity pool for DGLD is the ability for users to access this pool using a wide range of ERC-20 wallets. To access the Uniswap V2 liquidity pool for DGLD, users will simply need to connect their wallet to Uniswap holding USDC and ETH for gas, and swap USDC for DGLD. The use of USDC as the other side of the liquidity pool allows for ease of access, lower costs of transaction, as USDC is widely available and accessible, and will also help mitigate impermanent loss for individuals who are interested in providing liquidity. In addition, many individuals who value the sovereignty of their stores of value, have highlighted their desire to replace their US dollar holdings for gold. Individuals who would like to purchase DGLD directly using fiat onramps, will soon be able to do so directly on our website through our partnership with Transak.

The launch of a Uniswap V2 liquidity pool for DGLD offers a new and accessible way for users to trade and access digital gold. The benefits of decentralized exchanges and the DGLD token's gold-backing provides a high level of stability and security for users. This marks DGLD’s first step in its integration in Decentralised Finance.